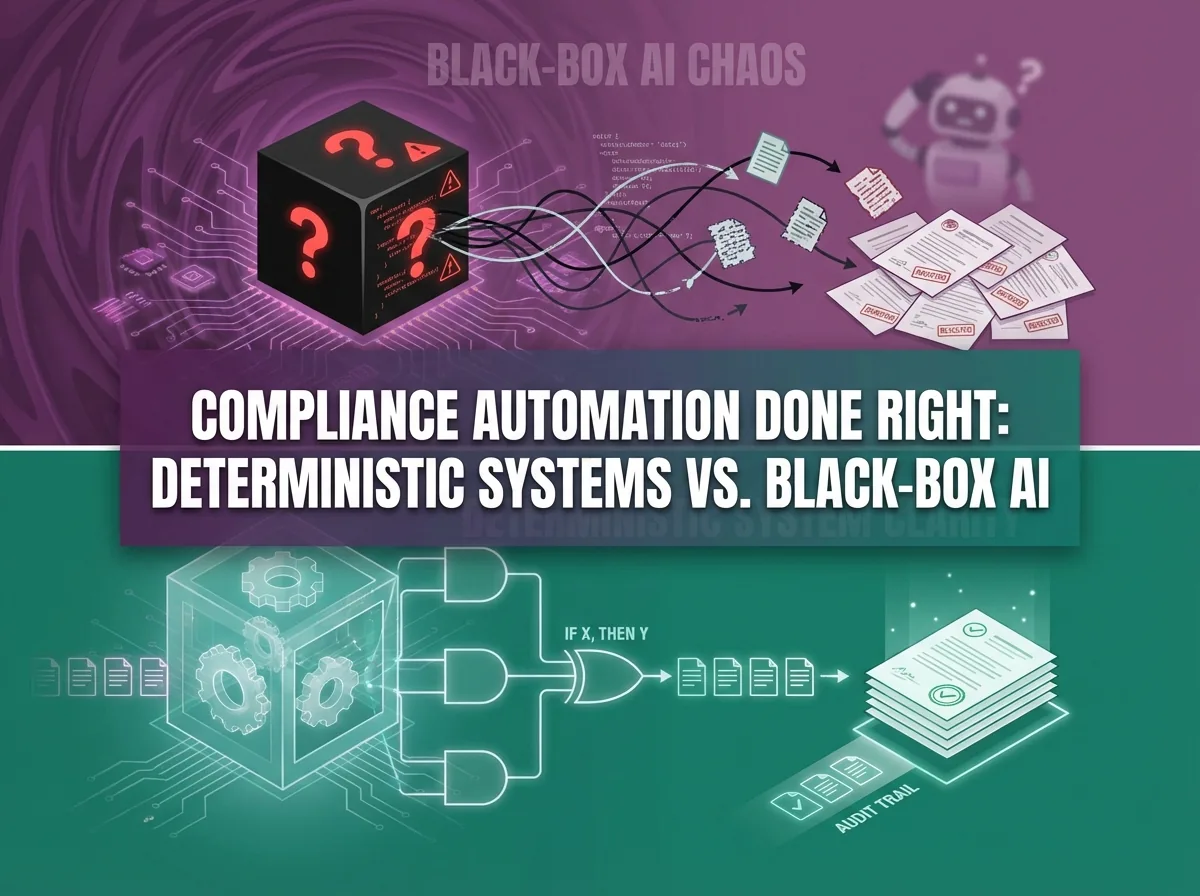

Compliance Automation Done Right: Deterministic Systems vs. Black-Box AI

The hype around AI automation is dangerous for compliance work. Learn why deterministic systems beat black-box AI agents for regulatory submissions, and how to build automation that auditors can actually trust.

Why "AI Agents" Will Wreck Your Audit Trail

The hype around AI automation is at peak volume.

"Just use agents to handle compliance."

"Let AI do the work."

In regulatory work, that mindset is dangerous.

In this context, "hallucination" would be considered a malpractice.

If you deploy a black-box AI system to make compliance decisions and it confidently submits the wrong data to a regulator, guess who's liable?

Not the AI vendor. You.

You're the one explaining it to auditors. You're the one absorbing the financial and reputational hit.

The Compliance Automation Paradox

Here's the paradox:

The more important the work, the less you want it handled by probabilistic systems.

For compliance, you don't want:

-

"Mostly correct" regulatory submissions

-

"Pretty good" audit trails

-

An AI that "usually understands" the EU's latest requirements

Yet that's exactly what generic AI agents promise: speed and convenience, at the cost of reliability and auditability.

That tradeoff might be acceptable for marketing copy (like this blog) or internal summaries. It is not acceptable for systems that can trigger fines, investigations, or license issues.

Real Story: When Automation Nearly Triggered Massive Fines

To stay grounded, let's look at a documented real-world case where poor automation and weak auditability pushed an organization toward serious compliance exposure.

On the A14 Cambridge to Huntingdon Improvement Scheme in the UK (a £1.5bn joint venture between Costain, Skanska, and Balfour Beatty), the Integrated Delivery Team (IDT) was facing a potential £10M fine over materials compliance.

There was no single bad actor. It was the system:

-

Material requisitions were spread across spreadsheets, emails, and manual workflows

-

There was no single, authoritative audit trail regulators could rely on

-

Traceability from request to approval to usage was patchy and inconsistent

In other words, the "automation" was an accidental patchwork of tools and manual steps. It moved work forward, but it couldn't prove, in a regulator-ready way, that every material had been requested, approved, and used in line with the rules.

The risk was simple and brutal: without a robust, end-to-end audit trail, the project could not convincingly demonstrate compliance, and a multi-million pound fine was a real possibility.

To fix it, the team implemented a central, deterministic workflow system (documented in FlowForma's A14 IDT case study) that:

-

Tracked each step of the material requisition process

-

Logged who did what, when, and against which item

-

Produced complete, consistent audit trails on demand

The reported outcomes:

-

Processes completed at least 5x faster

-

Full traceability over requisitions and approvals

-

A defensible audit trail that helped them avoid the potential £10M fine

This is the pattern you see again and again:

-

When automation is opaque, brittle, or stitched together from UI automation, macros, and ad-hoc scripts, your audit story collapses.

-

When automation is deterministic, explicit, and rule-based, you get speed without losing control.

See a real-world example of this approach: The EUDR Compliance Bridge

Learn why manual compliance fails at scale and why automation becomes essential.

That's the standard compliance automation has to meet.

What "Compliance Automation Done Right" Looks Like

Instead of relying on probabilistic AI to "figure it out," you want deterministic systems that behave the same way, every time, for the same input.

Systems that:

1. Follow explicit logic

You should be able to read the rules and nod along.

Examples:

-

"If field X is missing, reject this record. Do not guess or auto-fill."

-

"If the counterparty is in a High Risk category, route to human review. Do not auto-approve."

-

"If a submission fails, queue it with a clear error code. Do not try random workarounds."

No improvisation. No silent retries against a mutated UI. Just clearly defined behaviors.

2. Have clear audit trails

Every meaningful step should leave a clean footprint:

-

What data came in

-

Which rules fired, in what order

-

Why a decision was made (approve, reject, escalate)

-

Who or what made the call (system vs. human)

If a regulator asks, "Why was this submission refused?" you should be able to answer in one screen, not via a week of log forensics.

3. Fail safely and explicitly

A good system:

-

Knows when it's outside its safe operating envelope

-

Surfaces errors immediately, with enough context to act

-

Escalates to people before harm is done

You want:

-

Explicit failure, not drifting silently

-

Clear alerts, not buried error messages

-

Deterministic retry logic, not "keep clicking until something works"

The Architecture: RegOps Over AI

If you want to see this idea applied to EUDR-style work, take a look at the RegOps Bridge approach:

See our RegOps Bridge architecture

The key insight:

We don't use AI to make compliance decisions.

We use code to encode the rules, and humans to handle exceptions and edge cases.

Where AI can help:

-

Extracting structured data from messy documents

-

Classifying documents into well-defined buckets

-

Suggesting mappings that a human then confirms

Where AI should not be in charge:

-

Final regulatory decisions

-

Threshold checks

-

Formal submissions that could trigger liability

A Reddit user in r/fintech summed it up nicely:

"Agents can be fast and consistent, but they can also confidently make the wrong call if the environment, the UI, or the case logic changes."

That's exactly the concern.

Compliance systems need to be:

-

Boring

-

Predictable

-

Inspectable

You're not trying to impress anyone with cleverness. You're trying to sleep at night.

Three Questions to Ask About Any Compliance Automation

Before you adopt any tool, framework, or "agentic" approach for compliance work, ask these three questions.

1. Can I see exactly what it's doing?

You should be able to trace:

-

Why a submission was made

-

Why another was rejected or held

-

Which rules applied, with what inputs

If the best explanation you can get is, "The model thought this was correct," that's a red flag.

Audit trail transparency is not negotiable.

2. Does it fail safely?

Look at failure modes:

-

How does it behave when a UI or API changes?

-

What happens under network flakiness or partial outages?

-

Can it distinguish between "bad data" and "temporary infrastructure issue"?

You want systems that:

-

Retry intelligently for transient errors

-

Stop and alert for structural changes or unexpected responses

-

Make it obvious when something has gone wrong

If a tool just keeps hammering the same endpoint or UI hoping to succeed, it's building up silent risk.

3. Is it deterministic?

Given the same input:

-

Will it make the same decision 100 times in a row?

-

Or is there inherent randomness in the process?

If the outcome is probabilistic, your compliance exposure is, too.

If you can't answer this question clearly, you have a risk problem, not an automation strategy.

Build vs. Buy: When Custom Compliance Automation Makes Sense

There's a longer breakdown here:

But in short:

When to buy off-the-shelf

It usually makes sense to buy when:

-

The problem is generic (payroll, basic invoicing, HR onboarding)

-

You're okay adapting your workflow to match the tool

-

Deep integration and fine-grained controls aren't critical

In these cases, the vendor's standard workflows are often good enough, and you benefit from their scale.

When to build custom

It usually makes sense to build when:

-

Your workflows encode specific regulatory requirements or niche regimes

-

You need tight integration with existing data sources, CRMs, internal tools

-

You can clearly quantify ROI (cycle time, error rate, staff hours, reduced risk)

-

Auditability is a top-tier concern, not a "nice to have"

For most regulatory consultancies, core compliance workflows live in this "build" category:

-

They're too differentiated to be generic

-

The risk of getting them wrong is too high

-

They're directly tied to your value proposition and pricing power

Buying a black box for the center of your compliance offering is, in that sense, a strategic risk.

Real Numbers: Cost of Black-Box vs. Deterministic

Let's put some rough numbers against the two paths.

Black-box AI approach

Typical profile:

-

SaaS: €500-5k/month

-

Operational risk: silent failures that surface late, often at audit time

-

Cleanup and remediation after a bad incident: €10-50k in staff time, discounts, legal, and reputational cost

You're not just paying the subscription. You're paying for unpredictability.

Deterministic RegOps Bridge

Typical profile:

-

One-time implementation: €8-18k

-

Behavior: explicit failures, clear logs, predictable workflows

-

Optional support / maintenance: €1.5-4k/month on a retainer if you want ongoing improvements and coverage

Over a 12-month horizon, the deterministic system is usually both:

-

Cheaper, because you're not paying incident tax

-

Safer, because you can prove what happened and why

That's before you account for the softer benefits: client trust, easier audits, and internal confidence.

Where You Should Land

You shouldn't be automating compliance for speed alone.

You should be automating it for:

-

Reliability

-

Auditability

-

Confidence when someone asks, "Show me how this works, end to end."

That means:

-

Building systems, not buying black boxes

-

Encoding rules in code so they can be tested, versioned, and reviewed

-

Using AI as a helper around the edges, not as the final decision-maker

If a solution "probably works," it doesn't belong anywhere near your regulatory perimeter.

If a system is deterministic, transparent, and boring in exactly the way regulators like, that's worth investing in.

See the business case for RegOps here.

Stuck with black-box automation and want to see what a deterministic approach could look like?

Let's talk about building a compliance system you can actually trust

Ready to automate your workflow?

Schedule a 30-minute call to discuss your automation needs. We'll help you identify your biggest bottleneck and show you what's possible.

Schedule a Call