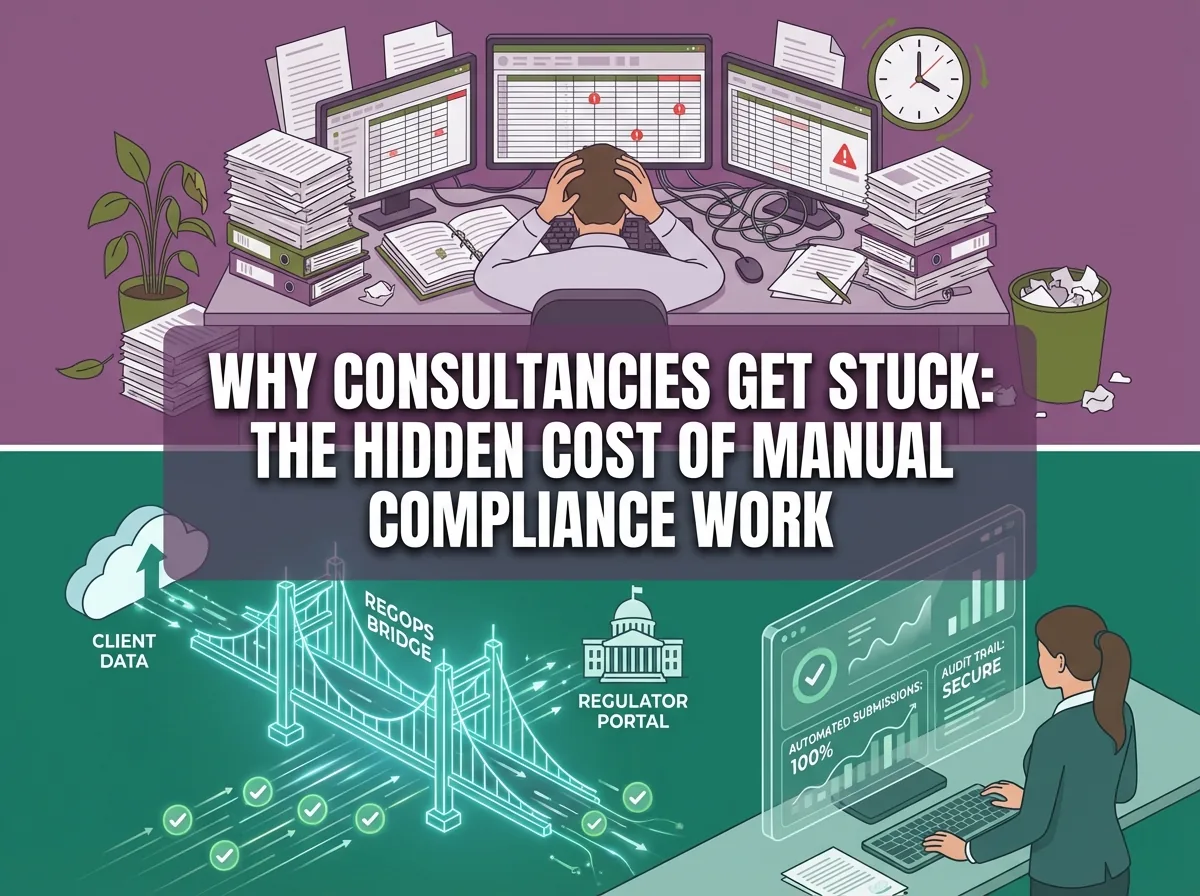

Why Consultancies Get Stuck: The Hidden Cost of Manual Compliance Work

If you run an ESG, EUDR, or regulatory consultancy, you probably recognize this pattern: every month, 100+ hours vanish into manual compliance work. Here's why hiring more people doesn't fix the problem and what actually does.

The 100-Hour Monthly Drain

If you run an ESG, EUDR, or regulatory consultancy, you probably recognize this pattern: every month, 100+ hours vanish into manual compliance work.

Not advisory. Not client strategy. Not high-value thinking. Just moving data around.

Your senior consultants, who you brought in for their regulatory expertise, end up spending most of their week on tasks that look like admin work. On paper, a $15/hour intern could do it. In reality, the work is too complex and too risky to delegate that way. So your $200/hour expert becomes a data-entry operator.

This is the trap many firms fall into. And you cannot solve it by hiring more people.

Why Hiring More People Does Not Fix the Problem

Every time you think about scaling capacity, the usual question is:

"Can we afford another analyst on €80-120k a year to handle all this manual work?"

In many cases, the real answer should be no. Not because you cannot find people, but because more people do not fix what is broken.

Here is why:

-

You have a process problem, not a headcount problem.

Adding more people to a flawed, manual process just means you have more people tied up inside that process. It does not change the bottleneck. It only makes the bottleneck more expensive.

-

Your clients care about outcomes, not how many people you assigned.

They pay for judgment and speed. They want clean submissions, low risk, and fast turnaround. If each new client doubles your manual workload, your margins shrink fast, no matter how good your delivery team is.

-

Your best people burn out doing the wrong kind of work.

The pattern is familiar:

-

You hire a sharp analyst.

-

You ask them to help "temporarily" with manual workflows.

-

Eighteen months later, they have spent most of their time in spreadsheets and portals.

-

They leave for a role where their brain is used more and their time is used better.

Then you start recruiting again.

-

If this cycle sounds familiar, the problem is not your talent pool. It is the way your operations are set up.

The Question That Unlocks Scale

Instead of asking, "Should we hire more people?" start asking:

"Which parts of this workflow could run in the background without a human touching them?"

Once you look at your operations through that lens, you stop thinking in terms of headcount and start thinking in terms of infrastructure. That is the point where real scale becomes possible.

Three Types of Compliance Work (Only One Needs a Human)

Most compliance workflows, whether ESG, EUDR, or other regulatory regimes, fall into three types of work.

Type 1: Data Ingestion and Validation

This is the front door of your process:

-

Collecting client data from emails, spreadsheets, and portals

-

Checking if required fields are present

-

Validating basic formats

-

Catching obvious mistakes before they move downstream

Who should do this? Automation. Fully.

Machines are good at repetitive checks. Humans are not.

Type 2: Routine Transformation and Submission

This is where data gets shaped into regulatory output:

-

Converting raw client data into the formats regulators expect

-

Applying standard rules and validations

-

Submitting to government portals and recording confirmations

Who should do this? Automation, almost always.

These steps follow rules. Once those rules are clear, software can execute them at scale and with consistent quality.

Type 3: Judgment and Exception Handling

This is where your expertise matters:

-

Reviewing edge cases flagged by the system

-

Making calls on ambiguous or borderline data

-

Explaining trade-offs and decisions to clients

-

Managing the relationship and building trust

Who should do this? Your people. Always.

This is where your team creates value and where your firm differentiates itself.

Most consultancies flip this balance. They automate a small slice (around 20%) and rely on people for the remaining 80%. High-performing firms do the opposite. They automate 70–80% of the work and reserve human time for Type 3 only.

Want to see what that looks like in practice? We break it down here

Why Many Automation Efforts Fail

You might be thinking, "We tried to automate. It did not really work."

That is common. The issue is rarely the idea of automation itself. It is how it was built.

Weak automation usually:

-

Relies on screen-scraping or fragile "AI agents" that fail when a portal layout or field name changes

-

Hides its logic, so you end up with a black box that is hard to defend in an audit

-

Needs someone watching it all the time "just in case"

-

Adds more things to track instead of simplifying your workflow

Robust automation instead:

-

Uses APIs and clear, deterministic logic wherever possible

-

Keeps a full audit trail so you know exactly what ran, when, and on which data

-

Runs quietly in the background instead of demanding attention

-

Reduces the number of manual steps, handovers, and tools your team needs to manage

The difference between the two is not a buzzword. It is design.

We explain why generic "AI" is rarely the right starting point for this kind of work here: RegOps strategy overview

What a Better Setup Looks Like: An EUDR Case

A French operator came to us struggling to keep up with EUDR submissions. Their internal team was overwhelmed. They were at a crossroads.

They had two real options:

Path A: Hire More Analysts

-

Cost: Around €120k per analyst per year

-

Impact: Slightly more capacity on the same fragile, manual process

-

Risk: Every new analyst learns and reinterprets the process slightly differently

Path B: Build a RegOps Bridge

-

Cost: One-time development of a dedicated workflow

-

Impact:

-

Automated data ingestion and validation

-

Standardized transformation and submission

-

A central dashboard and full audit trail

-

Capacity to handle many times the previous volume without a similar jump in headcount

-

They chose Path B.

Their team moved away from constant manual firefighting and started focusing on higher-value tasks: explaining regulatory changes, advising on upstream data quality, and planning for upcoming obligations rather than chasing the last filing.

We walk through how this was set up in detail here: EUDR RegOps Bridge

Is Your Consultancy at This Point?

A simple way to check is to ask yourself three questions:

-

Are you turning down work because your operations team cannot absorb more volume without risking quality?

-

Are your best people spending hours on manual tasks because there is no infrastructure to support or automate them?

-

Do you have recurring filing cycles (monthly, quarterly, annually) that look almost identical across clients?

If you answered "yes" to at least two of these, your main challenge is probably not staffing.

You are likely missing the operational bridge that sits between your clients and the regulators.

We call this a RegOps Bridge. You can read more about the concept and strategy here:

Why a RegOps Bridge beats "just hiring more people"

What Needs to Change

This shift is not about buying a generic software tool or adding a plugin to your current stack.

It is about building the right infrastructure around your team so that:

-

Data collection, checks, and formatting happen automatically

-

Filing and submissions are consistent and traceable

-

Exceptions are highlighted clearly for human review

-

Your consultants spend their time on judgment, not on chasing spreadsheets

When that infrastructure is in place, your business model changes.

You stop asking, "How many more people do we need?" and start asking, "What else can we run through this system?"

If you want to go deeper:

Stuck in manual compliance work and want to see what a different model could look like?

Let's talk about what a RegOps Bridge would mean for your firm

Ready to automate your workflow?

Schedule a 30-minute call to discuss your automation needs. We'll help you identify your biggest bottleneck and show you what's possible.

Schedule a Call