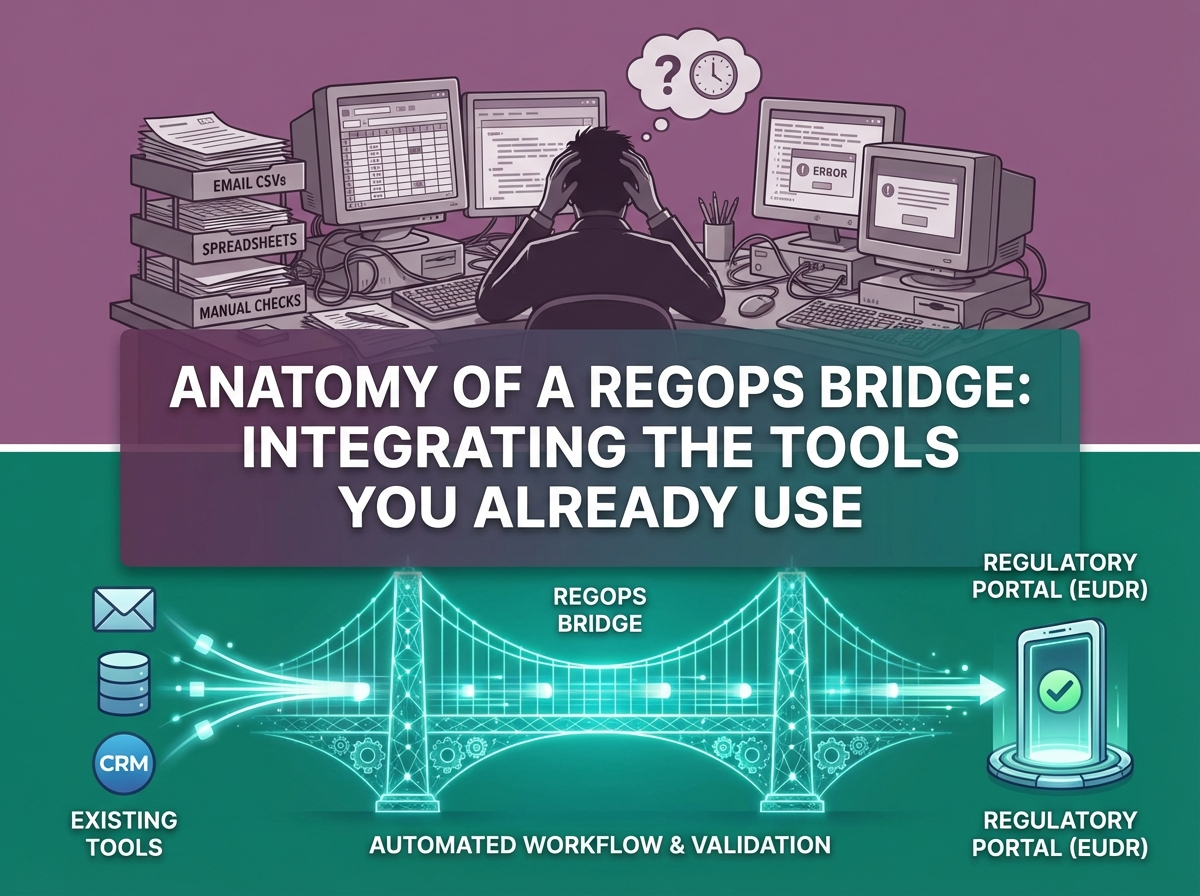

Anatomy of a RegOps Bridge: Integrating the Tools You Already Use

You don't need to rip and replace your existing tools to automate compliance. Learn how to build a RegOps Bridge that connects your clients' messy reality with regulators' rigid portals—without asking anyone to change their core tools.

You Don't Need to "Rip and Replace" to Automate

When we talk about automation with small consultancies, one fear comes up every time:

"Are you about to tell us we need a new CRM, new portal, new everything? We just got everyone used to HubSpot/SharePoint/Excel."

You don't.

The most effective automation doesn't replace your existing stack. It connects it. That's the core of the RegOps Strategy: you're not building a new ERP, you're building a bridge between your clients' messy reality and the regulator's rigid portal.

That bridge connects:

-

The tools your clients live in (Email, Excel, CSV exports)

-

The tools your team lives in (CRM, shared Drives, ticketing)

-

The tools regulators force you to use (legacy portals, SOAP APIs, strange file formats)

Case Study: The EUDR Filing Engine

We recently built a RegOps Bridge for a consultancy handling high-volume EUDR submissions. Below is how we wired together "messy reality" and "rigid regulation" without asking anyone to change their core tools.

The Challenge: The "Manual Middle"

Their setup looked familiar:

-

Inputs: Clients emailing CSVs and spreadsheets.

-

Process: Analysts manually checking each file against EUDR rules.

-

Output: A strict SOAP API endpoint from the EU Commission.

The painful part sat in the middle. Analysts were:

-

Opening attachments

-

Checking formats and values

-

Cross-referencing prior submissions

-

Manually preparing payloads for a fragile, legacy API

That "Manual Middle" is where 90% of the cost was hiding. It's also the bottleneck that creates the Consultancy Trap: more clients means more analysts, not more margin.

The Solution Architecture

We introduced a middleware layer (Python/FastAPI) to sit between "what clients send" and "what regulators expect."

You can think of it as a traffic controller with three main layers.

1. The Intake Layer: Meeting Clients Where They Already Are

Instead of rolling out a new client portal and fighting adoption, we kept the intake exactly where clients were comfortable: email and simple uploads.

The intake layer handled:

-

Watch Folders / Email Parsing

-

A specific "incoming" folder (or mailbox) is monitored.

-

New files are picked up automatically and routed into the engine.

-

-

Auto-Validation

As soon as a file arrives, the system runs a series of checks:

-

Is the

Reference Numberin the expected format? -

Are date fields valid and in the right range?

-

Are mandatory columns present and non-empty?

-

-

Immediate Feedback to Clients

If something is wrong, the client doesn't wait hours for an analyst to notice. The system:

-

Generates a clear error report (row numbers, fields, and reasons)

-

Sends an automatic, polite email back to the client

-

Logs the event for audit

-

Analysts now see mostly clean files. Their time is spent on judgment, not on chasing missing dates in column F.

2. The Logic Layer: Codifying the "Heroic Analyst"

Before automation, senior analysts were the "compiler" for the rules:

-

They knew which countries were high-risk.

-

They remembered if a shipment ID had been seen before.

-

They knew how to twist an Excel row into what the EU wanted.

We pulled that into code.

Key components in the logic layer:

-

Risk Logic

-

Example:

if country in HIGH_RISK_LIST: flag_for_manual_review = True -

All risk rules are explicit, versioned, and testable.

-

-

Deduplication

-

For each incoming shipment ID, the system checks:

"Has this ID been submitted before? If yes, how and when?"

-

This prevents accidental double filings and inconsistent records.

-

-

Transformation

-

Converts simple tabular structures (Excel/CSV) into the complex XML/JSON formats expected by the EU.

-

Handles:

-

Field mapping

-

Data type conversions

-

Unit normalization

-

Nested object creation

-

-

-

Why do this in code instead of with generic AI?

As we explain in our strategy analysis:

-

Compliance decisions are often binary: pass/fail, yes/no.

-

A "pretty close" answer is still a regulatory failure.

-

You want deterministic, testable logic that passes audits and survives staff turnover.

-

This logic layer turned tribal knowledge into an asset. New hires rely on the engine, not on remembering every edge case from training.

3. The Submission Layer: Handling the "Last Mile" Pain

This is where many generic automation tools struggle.

The EU portal used:

-

Legacy SOAP endpoints

-

Strict timeouts

-

Mutual TLS and certificate requirements

-

Unclear error responses

We built a dedicated submission layer that focuses purely on reliability:

-

Retry Engine

-

Automatic retries on transient failures (network hiccups, temporary timeouts)

-

Backoff strategies to avoid hammering the EU endpoint

-

Full logging of each attempt and outcome

-

-

Resilience to Edge Cases

A comment from a r/fintech user captures the problem well:

"Most failures in compliance automation come from edge cases... or missing context."

To address that:

-

If the EU portal is down, submissions are queued and retried later.

-

If an error indicates missing or conflicting data, the system:

-

Flags the record

-

Pushes it into a manual review queue

-

Notifies the appropriate team or channel

-

-

Nothing just "disappears" into a black box. Every failure is visible and traceable.

-

-

Certificate & Credential Management

-

The system monitors certificate expiry.

-

When a certificate is nearing expiry, it raises alerts well in advance.

-

If a certificate actually expires, the bridge:

-

Stops trying to submit

-

Surfaces a clear, actionable alert

-

Avoids silent partial failures

-

-

The outcome: the "last mile" to the regulator is no longer a brittle script someone wrote three years ago and is afraid to touch. It's a maintained component of your RegOps Bridge.

The Tech Stack That Works for a 20-Person Consultancy

You don't need a giant platform to do this. For most small teams, a practical RegOps stack looks like:

-

Intake

-

Typeform or Cognito Forms for structured client data

-

Or "just Excel" with enforced templates for teams not ready for forms

-

-

Orchestration

-

Make (formerly Integromat) or n8n for:

-

Simple "if this, then that" flows

-

Triggering pipelines when files or forms arrive

-

-

Python/FastAPI for:

-

Complex validation and transformation logic

-

Integration with legacy or strict APIs

-

-

-

Database / Audit

-

Airtable for lightweight tracking and status dashboards

-

Or a managed PostgreSQL instance for:

-

Full audit logs

-

Versioned rule sets

-

Detailed submission history

-

-

-

Notifications

-

Slack/Teams channels for:

-

Failed validations

-

Queue backlogs

-

Certificate or API issues

-

-

Auto-generated emails for:

-

Client error reports

-

Submission confirmations

-

Exception escalations

-

-

Most of this can be introduced gradually. You can start with just the intake and validation layer and plug in the submission layer later.

Why This Matters: Build the Bridge, Own the Traffic

By building this bridge, the EUDR firm didn't only save analyst hours. They created:

-

A repeatable filing engine they control

-

A defensible advantage: they can confidently process far more volume with the same headcount

-

A platform they can extend to other regimes and jurisdictions

Their competitors are still copying values from Excel into portals. This firm now has a proprietary engine that can handle 10x the workload and surface issues earlier and more clearly.

If you're wondering whether the investment pays off, see the business case for building this kind of bridge now.

You already have the basic pieces: email, spreadsheets, CRM, shared drives. The RegOps Bridge is what turns them into a system.

If you want to explore how to build a RegOps Bridge for your consultancy:

Ready to automate your workflow?

Schedule a 30-minute call to discuss your automation needs. We'll help you identify your biggest bottleneck and show you what's possible.

Schedule a Call