RegOps: The Missing Link for Scaling Your ESG Consultancy

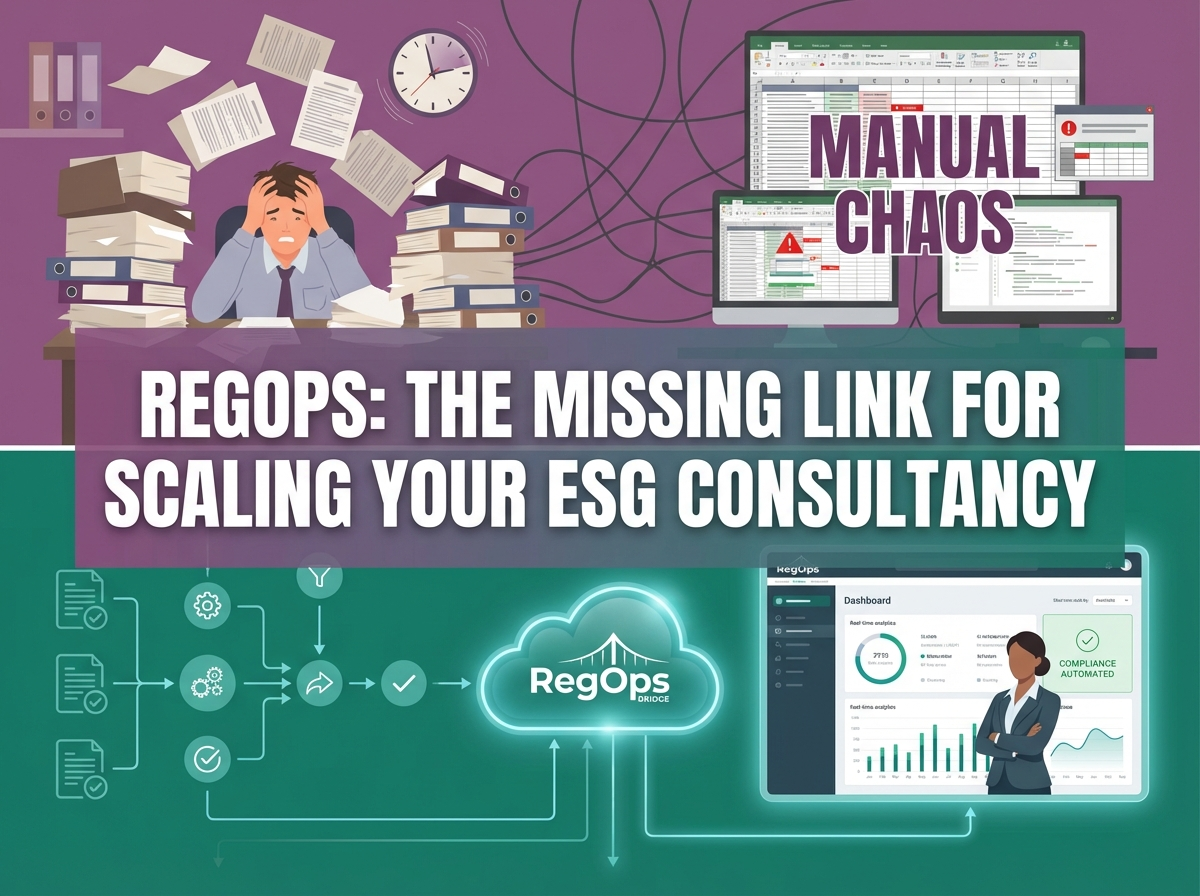

Stop running your consultancy on spreadsheets. Learn how RegOps bridges can help you scale without adding headcount, improve auditability, and build a stronger valuation.

Stop Running Your Firm on Spreadsheets

We speak to a lot of consultancy owners. The pattern is painfully familiar:

"We have great clients. We have smart consultants. But our back-office is a mess of spreadsheets, shared drives, and anxiety."

You are selling a premium service: regulatory assurance. But behind the scenes, the work is held together by manual effort, copy-paste, and fragile processes that haven't really changed since 2010.

That is The Consultancy Trap in action: using expensive, highly trained people to wrangle low-value data problems.

This is where RegOps (Regulatory Operations) comes in. It is the shift from "doing compliance by hand" to engineering how compliance happens.

What Is a "RegOps Bridge"?

A RegOps Bridge is infrastructure that sits between:

- your client's messy, inconsistent data, and

- the regulator's strict, unforgiving requirements

Instead of your team being the manual glue between those two worlds, the Bridge handles it.

It:

- accepts and validates client data

- enforces rules and schemas

- formats everything for the regulator

- tracks every step in an auditable way

Your team still sets the rules and makes the expert decisions. But they stop being human middleware.

You can see a more detailed breakdown in the technical architecture of a Bridge.

The "Old Way" vs The RegOps Way

The Old Way: Fragmented and Stressful

- Client emails a spreadsheet (

Version_Final_v2.xlsx). - Junior analyst opens it, checks for missing fields.

- Analyst copies the data into a "Master Sheet."

- Senior Manager reviews the Master Sheet.

- Analyst logs into the government portal and manually types everything in.

- Analyst takes a screenshot as "proof" and emails the client.

This works. Until it doesn't.

- One typo can trigger a regulatory issue.

- One missed email can delay a filing.

- One broken spreadsheet can kill a deadline.

And as volumes grow, your team just works later and later.

The RegOps Way: A Clean, Auditable Pipeline

- Client uploads data via a secure form or portal.

- The Bridge validates it immediately and rejects anything that doesn't meet the rules.

- The Bridge transforms and formats it for the regulator's schema.

- A Manager reviews everything in a single dashboard and clicks "Approve."

- The Bridge submits via API, stores the receipt, and logs the full audit trail.

Your people still oversee everything. But instead of doing data entry and triage, they're supervising a pipeline.

Why "Generic AI" Won't Fix This

You might be thinking:

"Can't I just throw ChatGPT or an AI agent at this?"

In a low-stakes environment, maybe. In a regulatory context, that is dangerous.

In this world, "hallucination" is just a polite word for malpractice.

As we break down in more depth in our technical deep dive on the logic layer, generic AI agents:

- don't have a guaranteed, stable logic path

- can misinterpret small UI changes

- can "confidently" do the wrong thing without warning

A recent r/fintech thread on compliance automation put it bluntly:

"Agents can be fast and consistent, but they can also confidently make the wrong call if the environment, the UI, or the case logic changes."

From r/automation:

"I don't trust AI ENTIRELY... there has to be a next level to compliance automation."

That "next level" is RegOps.

A RegOps Bridge is deterministic:

- It runs on explicit rules and schemas.

- It validates data against known structures.

- It produces the same output for the same input every time.

It doesn't "guess." It executes.

You can still use AI where it makes sense (for example, summarising narratives or extracting entities from unstructured documents), but the operational core is rule-based, testable, and auditable.

Why a RegOps Bridge Pays Off

So why would you spend €10k+ to build one of these workflow bridges?

Because you're not just "saving a bit of time." You're upgrading the entire operating model of your firm.

1. Scale Without Adding Headcount

With a Bridge in place, a large portion of the "grunt work" disappears:

- No more manual schema checks.

- No more endless spreadsheet versioning.

- No more rekeying data into portals.

The effect is simple: you can take on more clients and more volume without hiring a corresponding number of analysts.

We dig deeper into this dynamic in breaking the "heroic ceiling", where growth stalls because everything depends on heroic individual effort.

2. Built-In Auditability

Every step is logged:

- When data came in

- Who approved it

- What was submitted

- What the regulator responded with

You move from "I think we sent that" to "Here is the exact event log and receipt."

That matters when:

- clients ask questions six months later

- regulators request evidence

- you want to sleep at night

3. A Better Client Experience

Clients are tired of:

- being chased for the same documents

- sending files via email and hoping they're received

- having no visibility into where things stand

With a Bridge-backed workflow, they get:

- a secure portal to upload data

- immediate feedback if something is incomplete

- a simple dashboard that shows status and receipts

You start to look less like a "busy consultancy" and more like a modern productised service.

4. A Stronger Valuation

Two ESG consultancies with identical revenue can be worth very different amounts:

- Firm A runs on spreadsheets, heroics, and long nights.

- Firm B runs on internal IP, automation, and repeatable workflows.

Buyers pay more for Firm B, because:

- It is easier to grow without breaking.

- Its delivery is not tied to a small number of "heroes."

- Its know-how is encoded in systems, not only in people's heads.

As a simple rule of thumb, a consultancy that runs on code and IP is often worth around 3x what a purely time-and-materials firm with the same top-line can command.

Is Your Firm Ready for RegOps?

You don't need thousands of employees or a dedicated engineering team to make this work.

In fact, the firms that benefit most often look like this:

- 5-30 employees

- recurring regulatory work (e.g. ESG, sustainability, financial compliance)

- constant pressure at peak deadlines

- owners who can feel that "just hire another analyst" is no longer a real plan

If that's you, you face a choice:

- keep hiring people to manage the chaos, or

- redesign the system so there is less chaos to manage.

The second option is RegOps.

Don't hire another analyst to manage the chaos. Fix the chaos.

If you want to explore how to build a RegOps Bridge for your consultancy:

Want to stress-test your current workflow? Book a 20-minute diagnostic call here to map your current process and see where a Bridge could remove the most friction.

Ready to automate your workflow?

Schedule a 30-minute call to discuss your automation needs. We'll help you identify your biggest bottleneck and show you what's possible.

Schedule a Call